Advertisement

-

Published Date

April 6, 2021This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

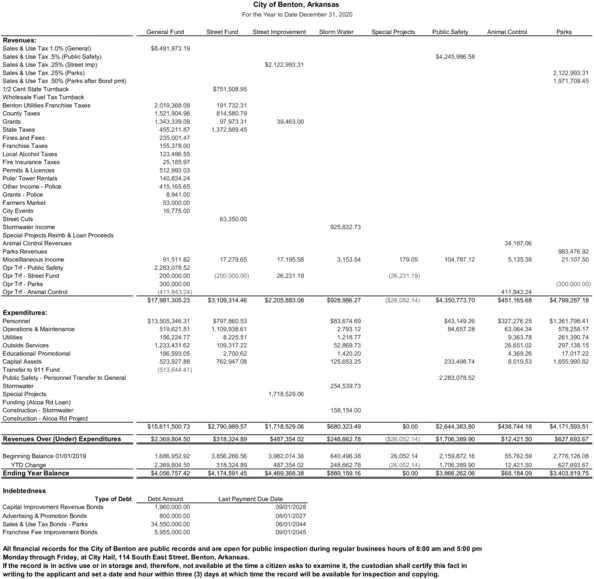

City of Benton, Arkansas For the Year to Date Decenber 31, 2000 General Fund Street Fund Street ingremert Storm Water Special Pec Pubi aty Animal Conteol Park Revenues: Sales & Use Tax 1.0% (General) Sales & Use Tax S% Pue Salety) Sales & Use Tax 20% (Seet imp) Sales & Use Tax 25% Parka) Sales & Use Tax 50% Parka after Bond pmt) 12 Cent State Tumback Wholesale fuel Tax Tumback Benton Ues Franchise Taxes S8491.971.19 $4,245.966 58 52,122.90031 2,122.90331 1,971,70045 S751.50.6 191,73231 814.50.79 2.019.368.09 County Taxes Grants 1.521.904 96 39.463.00 1,343,339.00 455,21187 97.97331 State Tanes 1,372.45 Fires and Fees Fandise Tas 235,001.47 Local Alcohol Taxes Pe Inuince Tas Fire 25, 185 97 Pemits &Licenoes Pole Tower Renals 512.99) 03 140.634 24 Oher ncome - Police 415,165 65 841.00 53.000 00 16,775.00 Grants - Police Famers Manat City Events Street Cuts 63.350.00 25.2.73 Animal Cortrol Revenues Pads Revenues Misoeltaneous income Oe Td- Putlic Salety Opr TH Sreet Fund Opr T-P Ogr Ti- Arinal Contre 34.187.06 983,476.92 91,51182 17.279.65 17,195.58 3,153.54 179.05 104,787.12 5,135 38 21,107 50 2,283.078.52 200.000.00 300.000 00 1411424 $17.901.305 23 (200,000.00) 26.231.19 (20.231.10 00.000 00) $3. 109.314.46 20.002 14) 41143.24 $451,16 68 $2.205.3.0 $4,350.773.70 $4,799.267.18 Expenditures: Personnel $43,149 26 $12.505.346.31 S19.2151 156,224.77 S79760 53 1,109.91 8225.51 109.317 22 2,700.62 762.947 08 $83.674 69 2.790.12 1218.77 $327 276 25 63.064 34 $1,361,741 S78.258 17 261,390.74 297.1315 17.017.22 1,655.900 82 Operations & Maindenance Ues 9.363.78 Outside Servioes 1,233,43162 529.73 20.051.02 Educationall Promotional Capital Assets Transter to 911 Fund Puble Salety - Persornel Transter ta General Stomwater Specal Proects Funding (Alcoa Rd Loan) Construction - Stomwater 4.369 26 8019 53 186.593.05 142020 523,827 88 125.653 25 233.498.74 (513,644 41) 2.283.078.52 254,530.73 1,718.529.06 158,154.00 Conetrucion Aicoa Rd Project $15.611,500.73 52,790,989.57 $1,718,529.06 S680.323 49 S0.00 $2,644.383.80 $438,744.18 $4,171,593.51 Revenues Over (Under) Expenditures $2.369.504 50 $318.324.89 S467 35402 $246.062.76 d2s.on2.14) $1.706.39 90 $12.42150 $627 683.67 1,66.92 2.3004 50 $4.006,757 42 20.002 14 Beginning Balance 01012019 YTD Change Ending Year Balance 3,6.266.56 314.324.80 $4,174,59145 3,902.014.36 487354.02 $4409338 640,490 36 245.662 78 Se09.159 16 2,159A72.6 55,762.59 2,776,126.08 26.062 14) $0 00 1,700.300 1242150 $3.06.262.06 S68.164.09 $3.403.819.75 Indebtedness Type of Debt Last Payment Due Date Debt Arount 1,0.000.00 Capital mprovement Revenue Bonds Advertising A Promotion Bonds Sales & Use Tax londs- Parka 08012027 800,000.00 34,500.000.00 5.95.000.00 Fanchiae Fee improvement Bonds All financial records for the City of Benton are public records and are open for publie inspection during regular business hours of 8.00 am and 5:00 pm Monday through Friday, at City Hall, 114 South East Street, Benton, Arkansas. IT the record is in active use or in storage and, therefore, not available at the time a citizen asks to examine the custodian shall certify this fact in writing to the applicant and set a date and hour within three (3) days at which time the record will be available for inspection and copying. City of Benton, Arkansas For the Year to Date Decenber 31, 2000 General Fund Street Fund Street ingremert Storm Water Special Pec Pubi aty Animal Conteol Park Revenues: Sales & Use Tax 1.0% (General) Sales & Use Tax S% Pue Salety) Sales & Use Tax 20% (Seet imp) Sales & Use Tax 25% Parka) Sales & Use Tax 50% Parka after Bond pmt) 12 Cent State Tumback Wholesale fuel Tax Tumback Benton Ues Franchise Taxes S8491.971.19 $4,245.966 58 52,122.90031 2,122.90331 1,971,70045 S751.50.6 191,73231 814.50.79 2.019.368.09 County Taxes Grants 1.521.904 96 39.463.00 1,343,339.00 455,21187 97.97331 State Tanes 1,372.45 Fires and Fees Fandise Tas 235,001.47 Local Alcohol Taxes Pe Inuince Tas Fire 25, 185 97 Pemits &Licenoes Pole Tower Renals 512.99) 03 140.634 24 Oher ncome - Police 415,165 65 841.00 53.000 00 16,775.00 Grants - Police Famers Manat City Events Street Cuts 63.350.00 25.2.73 Animal Cortrol Revenues Pads Revenues Misoeltaneous income Oe Td- Putlic Salety Opr TH Sreet Fund Opr T-P Ogr Ti- Arinal Contre 34.187.06 983,476.92 91,51182 17.279.65 17,195.58 3,153.54 179.05 104,787.12 5,135 38 21,107 50 2,283.078.52 200.000.00 300.000 00 1411424 $17.901.305 23 (200,000.00) 26.231.19 (20.231.10 00.000 00) $3. 109.314.46 20.002 14) 41143.24 $451,16 68 $2.205.3.0 $4,350.773.70 $4,799.267.18 Expenditures: Personnel $43,149 26 $12.505.346.31 S19.2151 156,224.77 S79760 53 1,109.91 8225.51 109.317 22 2,700.62 762.947 08 $83.674 69 2.790.12 1218.77 $327 276 25 63.064 34 $1,361,741 S78.258 17 261,390.74 297.1315 17.017.22 1,655.900 82 Operations & Maindenance Ues 9.363.78 Outside Servioes 1,233,43162 529.73 20.051.02 Educationall Promotional Capital Assets Transter to 911 Fund Puble Salety - Persornel Transter ta General Stomwater Specal Proects Funding (Alcoa Rd Loan) Construction - Stomwater 4.369 26 8019 53 186.593.05 142020 523,827 88 125.653 25 233.498.74 (513,644 41) 2.283.078.52 254,530.73 1,718.529.06 158,154.00 Conetrucion Aicoa Rd Project $15.611,500.73 52,790,989.57 $1,718,529.06 S680.323 49 S0.00 $2,644.383.80 $438,744.18 $4,171,593.51 Revenues Over (Under) Expenditures $2.369.504 50 $318.324.89 S467 35402 $246.062.76 d2s.on2.14) $1.706.39 90 $12.42150 $627 683.67 1,66.92 2.3004 50 $4.006,757 42 20.002 14 Beginning Balance 01012019 YTD Change Ending Year Balance 3,6.266.56 314.324.80 $4,174,59145 3,902.014.36 487354.02 $4409338 640,490 36 245.662 78 Se09.159 16 2,159A72.6 55,762.59 2,776,126.08 26.062 14) $0 00 1,700.300 1242150 $3.06.262.06 S68.164.09 $3.403.819.75 Indebtedness Type of Debt Last Payment Due Date Debt Arount 1,0.000.00 Capital mprovement Revenue Bonds Advertising A Promotion Bonds Sales & Use Tax londs- Parka 08012027 800,000.00 34,500.000.00 5.95.000.00 Fanchiae Fee improvement Bonds All financial records for the City of Benton are public records and are open for publie inspection during regular business hours of 8.00 am and 5:00 pm Monday through Friday, at City Hall, 114 South East Street, Benton, Arkansas. IT the record is in active use or in storage and, therefore, not available at the time a citizen asks to examine the custodian shall certify this fact in writing to the applicant and set a date and hour within three (3) days at which time the record will be available for inspection and copying.