Advertisement

-

Published Date

May 31, 2022This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

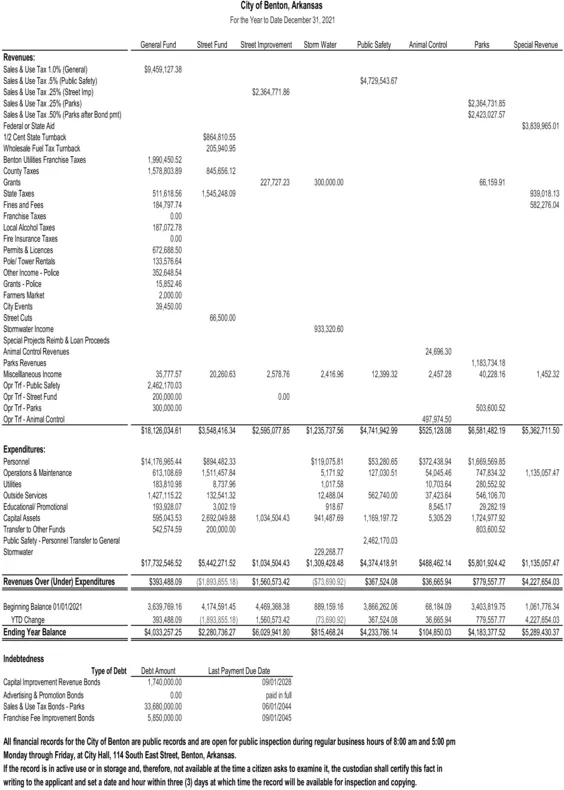

City of Benton, Arkansas For the Year to Date December 31, 2021 Gereral Fund Street Fund Steet Inprovement Stom Water Pubic Salety Aninal Control Parks Special Revenue Revenues: Sales & Use Tax 1.0% (General) Sales & Use Tax 5% (Public Safety) Sales & Use Tax 25% (Sreet Imp) Sales & Use Tax 25% (Parks) Sales & Use Tax 50% (Parks after Bond pmt) Federal or State Ad $9.459,127.38 $4,729.543.67 $2.36471 86 $2.364,731 85 $2.423,027 57 $3.839.965 01 12 Cent State Tumback Wholesale Fuel Tax Tumback Benton Utides Franchise Taxes County Taxes Grants State Taves S864.810.55 205.940.95 1,990 450.52 1,578.803.89 845,658. 12 227 727 23 300.00.00 66,159.91 511,618.56 1,545.248.09 939,018.13 184,797.74 0.00 187,072.78 Fines and Fees 582.276 04 Franchise Taxes Local Alcohol Taxes Fre Insurance Taxes 0.00 Pemits & Licences Polel Tower Rentals 672.688.50 133,576.64 352 648 54 15,852 46 2.000.00 Other Income - Polce Grants - Police Famers Market Cty Events Stret Cuts 39.450.00 66.500.00 933.320 60 Stomwater Income Special Projects Reimb & Loaen Proceeds Animal Control Revenues 24,896 30 Paks Reverues 1,183,734.18 40,228.16 1,452 32 35,777 57 2.462,170.03 200,000.00 300,000.00 2578.76 12.399 32 Mscellanecus hoome Opr Trf - Pubic Salety Opr Trf - Street Fund Opr Tit - Parks Opr Tif - Animal Control 20.260.63 2416.95 2457 28 0.00 503,600 52 $2.55.077 85 $1.235 737 56 $4,741,942 99 497 974.50 $525, 128 08 $18.126,034.61 $3.548,416.34 $6,581,482 19 $5,362,711.50 Expenditures: $14,170,965.44 613,108.69 183,810.98 1,427,115.22 193,928.07 595.043.53 542,574.59 $894,482.33 1,511,45784 8,737.96 132.541.32 $119.075.81 5.17192 1.01758 $372438 94 54.045 46 10.703.64 37 423 64 $1,669,569.85 747,83432 280.552 92 546,106.70 Personnel $53.280.65 Operatons & Maintenance Usites Outside Services 127,030.51 1,135,067 A7 12488.04 562.740.00 Educational Promotional 3.002.19 918.67 8.545.17 29.282.19 Captal Assets Transler to Other Funds Pubic Safety - Personnel Transter to General Stomwater 5,305 29 2.602.049.88 200.000.00 1,034,504.43 941,487 69 1,169,197.72 1,724,977 92 803.600 52 2462.170.03 $5.442 271.52 229 268.77 $1,309,42848 $17,732,546.52 $1,04.504.43 $4,374418.91 $48,462.14 $5,801.924.42 $1,135.05747 Revenues Over (Under) Expenditures $393,488.09 (51.893.855.18) S73.690 92) $367 524.08 $1,560,573.42 $36.665 94 $779,557.77 $4.227,654.03 Bagining Balanca 01012021 YTD Change Ending Year Balance 3.639 708. 16 4,174.59145 4,469,368.38 889, 159.16 68,184.09 3,866 262 06 367 524.08 $4.233.786. 14 3,403,819.75 1,061,778 34 (1,83.855 18) $2.280. 736.27 1,560 573.42 $6,029.941.80 (73 690.92) $815,468 24 36.665 94 $104.850 03 779.557 77 $4, 183.377 52 393,488.09 4227,654 03 $5.289,430 37 $4.033 257 25 Indebtedness Type of Debt Last Payment Due Date 09012028 Debt Amourt Captal Improvement Revenue Bonds Advertsing & Promotion Bonds Sales & Use Tax Bonds - Parks Franchise Fee Improvement Bonds 1,740,000.00 0.00 33,680,000.00 pad in tu 0601/2044 09012045 5,850,00.00 All fnancial records for the City of Benton are public records and are open for public inspection during regular business hours of 8:00 am and 5:00 pm Monday through Friday, at City Hall, 114 South East Street, Benton, Arkansas. If the record is in active use or in storage and, therefore, not available at the time a citizen asks to examine it, the custodian shall certify this fact in writing to the applicant and set a date and hour within three (3) days at which time the record will be available for inspection and copying. City of Benton, Arkansas For the Year to Date December 31, 2021 Gereral Fund Street Fund Steet Inprovement Stom Water Pubic Salety Aninal Control Parks Special Revenue Revenues: Sales & Use Tax 1.0% (General) Sales & Use Tax 5% (Public Safety) Sales & Use Tax 25% (Sreet Imp) Sales & Use Tax 25% (Parks) Sales & Use Tax 50% (Parks after Bond pmt) Federal or State Ad $9.459,127.38 $4,729.543.67 $2.36471 86 $2.364,731 85 $2.423,027 57 $3.839.965 01 12 Cent State Tumback Wholesale Fuel Tax Tumback Benton Utides Franchise Taxes County Taxes Grants State Taves S864.810.55 205.940.95 1,990 450.52 1,578.803.89 845,658. 12 227 727 23 300.00.00 66,159.91 511,618.56 1,545.248.09 939,018.13 184,797.74 0.00 187,072.78 Fines and Fees 582.276 04 Franchise Taxes Local Alcohol Taxes Fre Insurance Taxes 0.00 Pemits & Licences Polel Tower Rentals 672.688.50 133,576.64 352 648 54 15,852 46 2.000.00 Other Income - Polce Grants - Police Famers Market Cty Events Stret Cuts 39.450.00 66.500.00 933.320 60 Stomwater Income Special Projects Reimb & Loaen Proceeds Animal Control Revenues 24,896 30 Paks Reverues 1,183,734.18 40,228.16 1,452 32 35,777 57 2.462,170.03 200,000.00 300,000.00 2578.76 12.399 32 Mscellanecus hoome Opr Trf - Pubic Salety Opr Trf - Street Fund Opr Tit - Parks Opr Tif - Animal Control 20.260.63 2416.95 2457 28 0.00 503,600 52 $2.55.077 85 $1.235 737 56 $4,741,942 99 497 974.50 $525, 128 08 $18.126,034.61 $3.548,416.34 $6,581,482 19 $5,362,711.50 Expenditures: $14,170,965.44 613,108.69 183,810.98 1,427,115.22 193,928.07 595.043.53 542,574.59 $894,482.33 1,511,45784 8,737.96 132.541.32 $119.075.81 5.17192 1.01758 $372438 94 54.045 46 10.703.64 37 423 64 $1,669,569.85 747,83432 280.552 92 546,106.70 Personnel $53.280.65 Operatons & Maintenance Usites Outside Services 127,030.51 1,135,067 A7 12488.04 562.740.00 Educational Promotional 3.002.19 918.67 8.545.17 29.282.19 Captal Assets Transler to Other Funds Pubic Safety - Personnel Transter to General Stomwater 5,305 29 2.602.049.88 200.000.00 1,034,504.43 941,487 69 1,169,197.72 1,724,977 92 803.600 52 2462.170.03 $5.442 271.52 229 268.77 $1,309,42848 $17,732,546.52 $1,04.504.43 $4,374418.91 $48,462.14 $5,801.924.42 $1,135.05747 Revenues Over (Under) Expenditures $393,488.09 (51.893.855.18) S73.690 92) $367 524.08 $1,560,573.42 $36.665 94 $779,557.77 $4.227,654.03 Bagining Balanca 01012021 YTD Change Ending Year Balance 3.639 708. 16 4,174.59145 4,469,368.38 889, 159.16 68,184.09 3,866 262 06 367 524.08 $4.233.786. 14 3,403,819.75 1,061,778 34 (1,83.855 18) $2.280. 736.27 1,560 573.42 $6,029.941.80 (73 690.92) $815,468 24 36.665 94 $104.850 03 779.557 77 $4, 183.377 52 393,488.09 4227,654 03 $5.289,430 37 $4.033 257 25 Indebtedness Type of Debt Last Payment Due Date 09012028 Debt Amourt Captal Improvement Revenue Bonds Advertsing & Promotion Bonds Sales & Use Tax Bonds - Parks Franchise Fee Improvement Bonds 1,740,000.00 0.00 33,680,000.00 pad in tu 0601/2044 09012045 5,850,00.00 All fnancial records for the City of Benton are public records and are open for public inspection during regular business hours of 8:00 am and 5:00 pm Monday through Friday, at City Hall, 114 South East Street, Benton, Arkansas. If the record is in active use or in storage and, therefore, not available at the time a citizen asks to examine it, the custodian shall certify this fact in writing to the applicant and set a date and hour within three (3) days at which time the record will be available for inspection and copying.